16h 38m Left

Southern California 2.5 Acre Kern County Aerial Acres Property near Highway! Low Monthly Payment!{"message":"In _app.tsx child of Layout","renderCount":1}

California City, CA – 0.19 Acres of Land, Corner Lot, $1 No Reserve!

Lot Closed

Auction by Community Investment & Development LLC

This item is in , CA

Similar Items

2d 8h Left

Build Your Sanctuary in the Peaceful Pine Woods of Modoc County, California!$4,900.0016h 38m Left

Southern California Kern County Lot in California City Investment Property! Low Monthly Payments!16h 38m Left

11 Acres in Hudspeth County Texas With Dirt Road Frontage By Rio Grande! Low Monthly Payments!2d 7h Left

Invest in Polk County: 1.25 Acres in Central Florida!$6,000.008h 38m Left

Arkansas 5 Lot Cherokee Village Fulton County 1.44 Acres of Property Rare Adjoining Lots! Low Monthl8h 38m Left

Arkansas Fulton County Rare 1.13 Acre Quadruple Lot In Cherokee Village! Lot Monthly Payments!16h 38m Left

Texas 20 Acre Land Investment near Dell City and Highway in Hudspeth County! Low Monthly Payments!2d 7h Left

Discover Exciting Outdoor Escapades on 2.5 Acres in Los Angeles County!$10,000.008h 38m Left

DOUBLE LOT Rare Ozark Acres Arkansas Sharp County Adjoining Property just Blocks from Main Lake! Low2d 8h Left

Invest Along Michigan's Lakeshore Near Lake Erie!$3,900.002d 7h Left

Just "Under an Acre" to Build Your Home On & Bathe in California Serenity!$4,900.002d 7h Left

Buildable Lot in Peaceful Ozark Acres, Arkansas!$1,400.008h 38m Left

Hudspeth County Texas 20 Acre Land Investment near Dell City and Highway Route! Low Monthly Payment!16h 38m Left

California Aprox 1 Acre Modoc County Great Recreational Land Investment with Low Monthly Payments!2d 7h Left

This 2.50 Acre Parcel Offers You Gorgeous California Views!$4,900.008h 38m Left

Texas Hudspeth County 10.65 Acre Lot Close to Rio Grande River Available with Low Monthly Payments!2d 7h Left

Experience 1.32 Acres of Beauty and Culture in Arizona's Navajo Nation!$1,900.0016h 38m Left

New Mexico Platted Subdivision Lot in Valencia County near Albuquerque with Low Monthly Payments!16h 38m Left

Arkansas Fulton County Double Lot In Cherokee Village! Great Investment! Low Monthly Payments!35d 6h Left

Real Estate - 102 SW 55th St. Oklahoma City, OK. 73109$5,250.008h 38m Left

Arkansas Sharp County Lot in Cherokee Village! Outstanding Recreation near Lake! Low Monthly Payment2d 7h Left

Future Home Site in Canadian Lakes, Michigan!$4,900.0016h 38m Left

Arkansas Fulton County Rare Triple Lot in Cherokee Village! Great Recreation! Low Monthly Payments!$2.002d 8h Left

Build Just a Short 5-Minute Drive from the Saginaw River in Michigan!$1,900.008h 38m Left

CASH SALE! Arkansas Ozark Acres Lot Sharp County near Lakes and Parks with Road Frontage! File 64154$60.008h 38m Left

Arkansas Fulton County Rare Double Lot in Cherokee Village! Great Recreation! Low Monthly Payments!2d 8h Left

Easy Road Access to this LA County Lot!$7,000.0012d 7h Left

Vacant Parcel near Lake Arrowhead,$550.002d 7h Left

Buildable Lot in Battle Creek, Michigan!$1,900.002d 8h Left

Nearly an Acre in Red Bluff, California Near the Sacramento River!$3,900.0052d 7h Left

Method & TermsOverview of California City, CA – 0.19 Acres of Land, Corner Lot, $1 No Reserve!

Item Details

APN/Parcel ID287-233-01-00-2

Item Location - State/ProvinceCalifornia

Size0.19 Acres

CityCalifornia City

Area93505

StreetGriffith St. & Nathena Ave.

CountyKern

California City, CA – 0.19 Acres of Land, Corner Lot, $1 No Reserve!

ASSET DESCRIPTION:

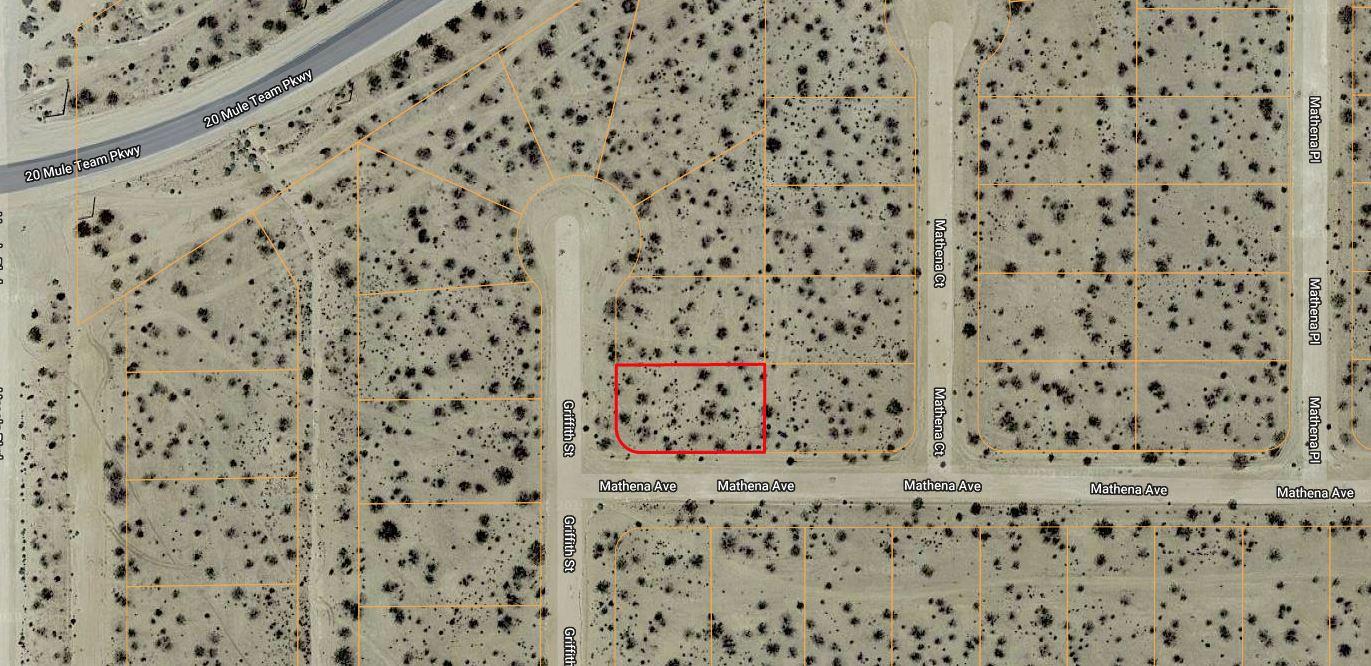

Property is 0.19 acres of vacant residential land at the corner of Griffith Street and Mathena Avenue (just off of 20 Mule Team Parkway) at the beginning of a cul-de-sac.

Legal Description: Lot 780 of Tract 3196

Address: Griffith St. & Nathena Ave., California City, CA 93505

County: Kern

ATN #: 287-233-01-00-2

Lot Size: 0.19 acres

Latitude/Longitude: 35.1879318,-117.7892609

Zoning: For Zoning information contact the City of California City

Buyer should thoroughly research property and title before bidding.

SETTLEMENT REQUIREMENTS: PLEASE SEE SPECIAL TERMS OF SALE.

ASSET DESCRIPTION:

Property is 0.19 acres of vacant residential land at the corner of Griffith Street and Mathena Avenue (just off of 20 Mule Team Parkway) at the beginning of a cul-de-sac.

Legal Description: Lot 780 of Tract 3196

Address: Griffith St. & Nathena Ave., California City, CA 93505

County: Kern

ATN #: 287-233-01-00-2

Lot Size: 0.19 acres

Latitude/Longitude: 35.1879318,-117.7892609

Zoning: For Zoning information contact the City of California City

Buyer should thoroughly research property and title before bidding.

SETTLEMENT REQUIREMENTS: PLEASE SEE SPECIAL TERMS OF SALE.

Payment

Please see Special Terms of Service and Lot Descriptions for payment instructions. ALL CHECKS MUST BE CERTIFIED CHECKS. Please contact the auction company prior to placing a bid, if you have any questions.

CheckMoney OrderWire Transfer

Auction Details

Comm. Investment & Development Real Estate Auction9901 Belward Campus Drive, Suite 175, Rockville, MD, 20850Tuesday, Feb 18, 2020 | 2:00 PM CST

Auction House

Terms Of Sale

Lots 1 through 4 (Cochise County AZ): Each have a starting bid of $1.00 with no reserve. This is a cash sale, you are bidding on the full purchase price. Buyer to pay closing costs of $695, which includes deed preparation, recording fees, and transfer taxes. Seller will handle the entire deed recording process and will convey property via Special Warranty Deed with as-is title, subject to any liens (should they exist) and property taxes for 2020 and after. These properties were acquired by the Seller through a Deed For Land Held By The State of Arizona Under Tax Deed. All taxes were paid through 2019. Full payment is due within 4 calendar days of the auction's close.

Lots 5 through 6 (Cochise County AZ): Each have a starting bid of $1.00, with no reserve. This is a cash sale, you are bidding on the full purchase price. Buyer to pay closing costs of $695, which includes deed preparation, recording fees, and transfer taxes. Seller will handle the entire deed recording process and will convey property via Special Warranty Deed with as-is title, subject to any liens (should they exist) and property taxes for 2020 and after. All taxes were paid through 2019. Full payment is due within 4 calendar days of the auction's close.

Lots 7 through 10 (Kern County CA): Each have a starting bid of $1.00, with no reserve. This is a cash sale, you are bidding on the full purchase price. Buyer to pay closing costs of $695, which includes deed preparation, recording fees, and transfer taxes. Seller will handle the entire deed recording process and will convey property via Special Warranty Deed with as-is title, subject to any liens (should they exist) and property taxes for 2019 and after. This property was acquired by the Seller through a Tax Deed To Purchaser of Tax Defaulted Property by Kern County, California. All taxes were paid through 2018. Full payment is due within 4 calendar days of the auction's close.

Lot 11 (Los Angeles County CA): THIS IS A BID & ASSUME AUCTION. You are bidding on the down payment and the full purchase price is $7,900. The interest rate is 9% and the duration of the note is 5 years. On a $1 down payment, the monthly payment would be approximately $215/month, including principal, interest, and property taxes. There is no prepayment penalty to pay the note off faster. The down payment (which will be equal to the winning bid) and a deed preparation and recording fee of $399 will be due within 3 business days of the auction’s close and may be paid by cashier’s check or wire transfer. The contract/note would then be provided and must be signed within 14 calendar days of the auction’s close, or else buyer may be declared in default. All monies paid are non-refundable. This property was acquired by the Seller through a Tax Deed To Purchaser of Tax-Defaulted Property by Los Angeles County, California. PROPERTY WILL BE CONVEYED VIA A SPECIAL WARRANTY DEED ONCE THE NOTE IS PAID IN FULL.

Lot 12 (Los Angeles County CA): THIS IS A BID & ASSUME AUCTION. You are bidding on the down payment and the full purchase price is $3,900. The interest rate is 9% and the duration of the note is 4 years. On a $1 down payment, the monthly payment would be approximately $106/month, including principal, interest, and property taxes. There is no prepayment penalty to pay the note off faster. The down payment (which will be equal to the winning bid) and a deed preparation and recording fee of $399 will be due within 3 business days of the auction’s close and may be paid by cashier’s check or wire transfer. The contract/note would then be provided and must be signed within 14 calendar days of the auction’s close, or else buyer may be declared in default. All monies paid are non-refundable. This property was acquired by the Seller through a Tax Deed To Purchaser of Tax-Defaulted Property by Los Angeles County, California. PROPERTY WILL BE CONVEYED VIA A SPECIAL WARRANTY DEED ONCE THE NOTE IS PAID IN FULL.

Lot 13 (Los Angeles County CA): THIS IS A BID & ASSUME AUCTION. You are bidding on the down payment and the full purchase price is $6,900. The interest rate is 9% and the duration of the note is 5 years. On a $1 down payment, the monthly payment would be approximately $161/month, including principal, interest, and property taxes. There is no prepayment penalty to pay the note off faster. The down payment (which will be equal to the winning bid) and a deed preparation and recording fee of $399 will be due within 3 business days of the auction’s close and may be paid by cashier’s check or wire transfer. The contract/note would then be provided and must be signed within 14 calendar days of the auction’s close, or else buyer may be declared in default. All monies paid are non-refundable. This property was acquired by the Seller through a Tax Deed To Purchaser of Tax-Defaulted Property by Los Angeles County, California. PROPERTY WILL BE CONVEYED VIA A SPECIAL WARRANTY DEED ONCE THE NOTE IS PAID IN FULL.

Lot 14 (Spartanburg County SC): This has a starting bid of $1.00, with no reserve. This is a cash sale, you are bidding on the full purchase price. Buyer to pay closing costs of $695, which includes deed preparation, recording fees, and transfer taxes. This property was acquired by the Seller through a Tax Deed from Spartanburg County South Carolina. The Seller will handle the entire deed recording process and will convey property via Special Warranty Deed with as-is title, and property taxes for 2019 and after. All taxes were paid through 2018. Full payment is due within 4 calendar days of the auction's close.

Lot 15 (Humboldt County NV): THIS IS A BID & ASSUME AUCTION. You are bidding on the down payment and the full purchase price is $11,900. The interest rate is 9% and the duration of the note is 10 years. On a $1 down payment, the monthly payment would be approximately $154/month, including principal, interest, and property taxes. There is no prepayment penalty to pay the note off faster. The down payment (which will be equal to the winning bid) and a deed preparation and recording fee of $399 will be due within 3 business days of the auction’s close and may be paid by cashier’s check or wire transfer. The contract/note would then be provided and must be signed within 14 calendar days of the auction’s close, or else buyer may be declared in default. All monies paid are non-refundable. This property was acquired by the Seller through a County Tax Deed by Humboldt County, Nevada. PROPERTY WILL BE CONVEYED VIA A SPECIAL WARRANTY DEED ONCE THE NOTE IS PAID IN FULL.

Lot 16 through 17 (Modoc County CA): Each has a starting bid of $1.00, with no reserve. This is a cash sale, you are bidding on the full purchase price. Buyer to pay closing costs of $695, which includes deed preparation, recording fees, and transfer taxes. There are back taxes due, and the Buyer should determine the amount due prior to bidding. Seller will handle the entire deed recording process and will convey property via Special Warranty Deed with as-is title, subject to any liens (should they exist) and back taxes. Full payment is due within 4 calendar days of the auction's close.

FOR ALL LOTS IN THIS AUCTION:

CAREFULLY READ EACH LOT DESCRIPTION FOR ALL OF THE TERMS OF THE SALE.

All property is sold as is, where is, with no warranties expressed or implied. It is the duty of prospective buyers to research properties to their satisfaction prior to bidding, and a bid shall constitute a binding contract, in which the buyer is agreeing to abide by the Terms of the Auction.

Some or all of the properties in this Auction were tax defaulted property acquired from Counties or municipalities. In some cases the seller may not inspect every property prior to sale. The seller represents these properties to the best of their knowledge. In some rare cases, property may have severe damage or be subject to county/city orders not described in the auction. It is highly recommended that interested bidders arrange for an external inspection personally or through a designate and that they contact the county or city in which the property is located to confirm the status of the property.

The seller reminds all potential real estate bidders that it is your responsibility to complete all due diligence needed to determine the condition, market value, or investment value of this asset prior to placing a bid. Necessary due diligence items may include, but are not limited to,

• A satisfactory inspection of the property

• Completion of a title search

• Investigating back property taxes and

• Other - liens and encumbrances such as unpaid utility bills.

By placing a bid, you acknowledge that any statements made by the seller about the condition or market value of the property are subjective, and do not release you from your responsibility to perform due diligence.

The Seller’s obligation to handle the entire deed recording process is dependent on Buyer signing and returning the completed documents to the Seller: (i) within ninety (90) days after the auction’s close, for those properties being sold without Owner Financing; and (ii) within ninety (90) days after the property has been paid in full by the Buyer, for Owner Financing properties. In the event the completed documents are not returned as provided above, the property may be resold by the Seller, and any Buyer funds may be retained by the Seller as liquidated damages.

It is understood and agreed that: (i) your bid is a binding contract to perform according to the terms of the auction, and you further agree to submit to the jurisdiction of Montgomery County, Maryland, which jurisdiction is the only place a legal action may take place; (ii) that Seller may take any legal action to enforce the contract between the Bidder and Seller; (iii) that you, the Bidder, will be responsible for all costs and expenses, (including legal expenses and court costs) in enforcing the agreement; and (iv) that notwithstanding any limitations of liability between the Bidder and ProxiBid, you agree to the Seller’s terms of service as provided above.